Features

Borrower,

Agent, and

TPO Portals

![]()

Borrower and Agent Portals

Custom-branded and tailored to your needs

Your own secure portals where borrowers and agents have 24/7 access to real-time status updates and notifications, can satisfy outstanding conditions and communicate throughout the loan process. A great web and mobile experience for all!

Email Campaigns

It's more than just set it and forget it

Automated emails go out to your internal staff, borrowers, realtors or any party involved in a transaction triggered at any stage of the process --- use our templates, create your own, you decide!

CRM, Dialer and

Lead Management

![]()

CRM and Lead Management

You may think you have this taken care of, find out how much you might be missing.

Are you referral-based? Buying leads? Refi? Purchase? There’s a lot to think about and we’ve figured out how to automate and get the most out of every touch. CRM and Lead Management requires a strategy, not just a system. We’ll help you capture your audience, and then we’ll help you incorporate everything necessary into your entire workflow.

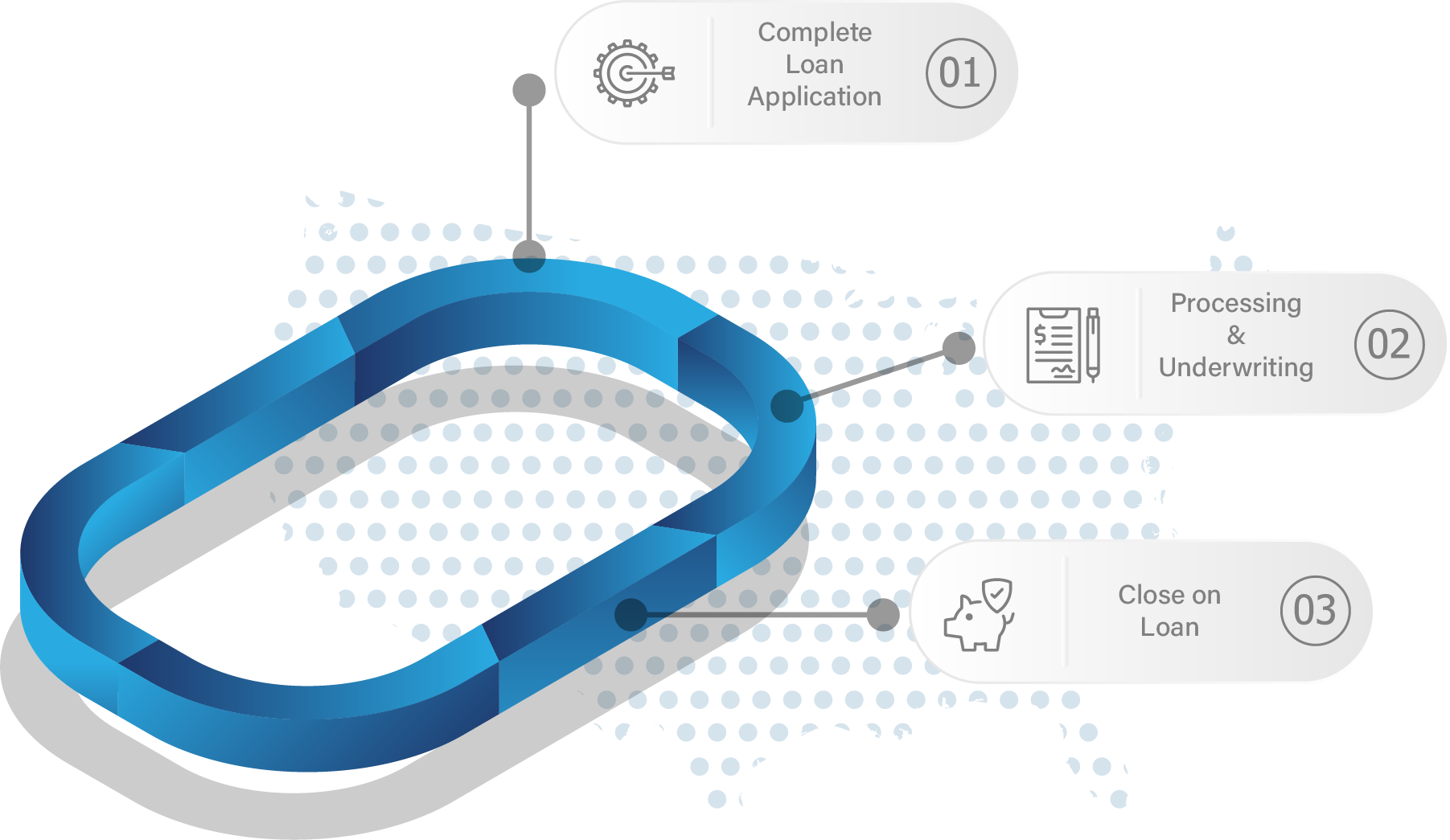

Loan Application,

Document Management,

POS and eSign

![]()

Loan Application, Document Management

and eSign

Dealing with documents just got a whole lot easier

We’ll help you automate the gathering of all documents so you’ll always know what's outstanding. Track, approve, reject, send for eSignature, and more all from a centralized dashboard.

Smart Tasks

and Workflow

This is where the magic happens.

Imagine if you had a robot that knew exactly what you wanted to do and when you wanted to do it. That’s basically how our workflow engine works. Configured to your needs, we’ll take automation to a new level.

Text Message and

Communication

![]()

Text Messaging

and Communication

Stay in front of your borrowers, agents, and team members

Eliminate the need for manual internal and external emails with our message and alert center. We can send texts, emails, instant messages, and more without you having to lift a finger.